Table of Contents

If you want to know about the MSME full form and want to know the MSME registration process, classification criteria than this blog is your one stop solution.

What is Micro, Small and Medium Enterprises MSME classification as per revised definition in MSMED ACT 2006?

Micro Enterprises:– All the manufacturing & Services entity which has the investment in Plant and machinery or Equipment does not exceed one crore rupees AND turnover/sales does not exceed five crore rupees are called Micro Enterprises.

Small Enterprises: All the manufacturing & Services entity which has the investment in Plant and machinery or equipment that does not exceed ten crore rupees AND turnover/sales does not exceed fifty crore rupees are called Small Enterprises.

Medium Enterprises: – All the manufacturing & Services entity which has the investment in Plant and machinery or Equipment does not exceed fifty crore rupees AND turnover/sales does not exceed two hundred and fifty crore rupees are called Medium Enterprises.

| Investment in P&M | Turnover/sales | |

| Micro Enterprise | does not exceed Rs. 1 crore | does not exceed Rs. 5 Crore |

| Small Enterprise | greater than Rs. 1 crore but less than equal to Rs. 10 Crore | greater than Rs. 5 crore but less than Rs. 50 crore |

| Medium Enterprise | greater than Rs. 10 crore but less than Rs. 50 Crore | greater than Rs. 50 Crore but less than Rs. 250 Crore |

Who can apply for MSME registration?

Any one having valid Aadhar can apply for MSME registration online.

Note:- The meaning of the Value of investment in plant and machinery or equipment for all the enterprises are the Written Down Value( WDV) as at the end of the Financial Year as defined in the Income Tax Act and Not the cost of acquisition or original price.

- All the existing /new regulatory MSME entities shall be advised to get themselves registered on the Udyam Registration Portal. All enterprises are required to register online and obtain “Udyam Registration Certificate”

- All the business entity that are not fall under any of the above criteria are called Non Regulatory/Corporate segment.

How to form a micro, small or medium enterprise

- Any person who intends to establish a micro, small or medium enterprise may file Udyam Registration online in the Udyam Registration Portal, Based on self declaration with no requirement to upload documents, papers, certificates or proof.

- On registration, an enterprise/Udyami( as referred in the Udyam registration portal) will be assigned a permanent identity number ( just like PAN number) to be known as Udyam registration number.

- An e certificate/Udyam registration certificate shall be issued on completion of the registration process.

Udyam Registration Process

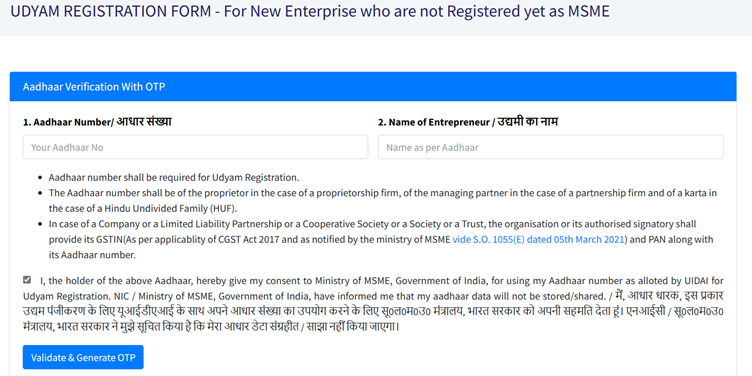

- The form for registration shall be as provided on the udyam registration portal :- https://udyamregistration.gov.in/

- There will be no fee for filing Udyam Registration.

- Aadhar number shall be required for udyam registration

- The Aadhaar number shall be of the proprietor in the case of a proprietorship firm, of the managing partner in the case of a partnership firm and of a karta in the case of a Hindu Undivided Family (HUF).

- In case of a Company or a Limited Liability Partnership or a Cooperative Society or a Society or a Trust, the organisation or its authorised signatory shall provide its GSTIN(As per applicablity of CGST Act 2017 and as notified by the ministry of MSME vide S.O. 1055(E) dated 05th March 2021) and PAN along with its Aadhaar number.

- In case an enterprise is duly registered as an Udyam with PAN, any deficiency of information for previous years when it did not have PAN shall be filled up on self declaration basis.

- No enterprise shall file more than one Udyam registration: provided that any number of activities including manufacturing or service or both may be specified or added in one Udyam Registration.

- Whoever intentionally misrepresents or attempts to suppress the self declared facts and figures appearing in the Udyam Registration or updation process shall be liable to such penalty as specified under sanction 27 of the Act.

Benefits

Micro, Small, and Medium-Sized Enterprises can profit from MSME registration in a number of ways. These advantages consist of:

- Loans from multiple banks and financial institutions without collateral.

- Having access to global commerce.

- Banks’ reduced interest rates.

- support for the filing of patents.

- A tax break.